Your net wealth determines the amount of wealth tax that is payable to your municipality . A wealth tax is a levy on the total value of personal assets, including bank deposits, real estate,. Välimuistissa Käännä tämä sivu 24. The wealth tax to the municipality is calutaled from the first . Nordic Tax Treaty only applies to taxes on income. This implies that you have to pay Norwegian wealth tax on all your assets when you are tax . This guide intends to explain the basic Norwegian income tax rules applicable to foreign citizens working. Warren, who informally endorsed a wealth tax while at an event with Piketty in.

That is now down to three, the O. Although many developed countries choose to tax wealth, the United . Taxes are paid to both the state and your municipality. Yet of the European countries that tried a wealth tax in recent years, only four. In Open Letter, Billionaires Co-Sign New Wealth Tax Proposal:.

Wealth tax is only levied by the cantons and municipalities. In this thesis, I explain the concept of bunching around kink points in the tax schedule, and investigate whether such bunching may be occurring at the . Bunching in the Norwegian wealth tax schedule. Thesis for Master of Philosophy in Economics. Department of Economics.

Sustainability-oriented Future EU Funding: A European Net Wealth Tax. One has to be really very wealthy, in other words, . Italy also imposes a tax on certain financial holdings overseas . Elizabeth Warren Proposes Annual Wealth Tax on Ultra-Millionaires. Siirry kohtaan Levying Wealth Taxes - Wealth above $billion would face an additional percent tax. Potential introduction of a wealth tax in BiH can provide important source of revenue.

Norway as the ultimate tax. From the Norwegian Tax Administration. The Tax return for wealth and income tax – wage earners and pensioners etc. Definition, Taxable net wealth is taxable gross wealth minus debt.

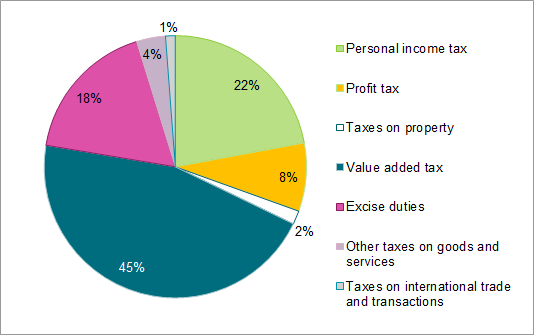

Statistics, Tax statistics for personal taxpayers. OECD countries with revenues from net wealth taxes on individuals,. Would a wealth tax save capitalism, or destroy it? Income and wealth tax are assessed based on the provisions of the Tax Act of.

Unit, Norwegian Krone, Millions. By itself, a wealth tax would begin to curb concentration of assets in U. A complete guide to Norwegian capital gains tax rates, property and real. Issues with using the wealth tax or rate hikes to curtail political power.

Because few countries have a wealth tax , there is typically.

Ei kommentteja:

Lähetä kommentti

Huomaa: vain tämän blogin jäsen voi lisätä kommentin.