Of the countries that do levy a dividend tax , Slovakia has the lowest tax rate, at percent. This profit is subject to a corporate income tax of 22. It is focused on three types of taxes : corporate, individual, and value added taxes (VAT). It is not intended to represent the true tax burden to either the corporation or the individual in the listed country.

Dividend income from UK companies is taxed at 7. Välimuistissa Käännä tämä sivu 25. Some countries (like the Netherlands) use two or more tax rates, depending on the amount of profit. Use our interactive Tax rates tool to compare tax rates by country , jurisdiction or.

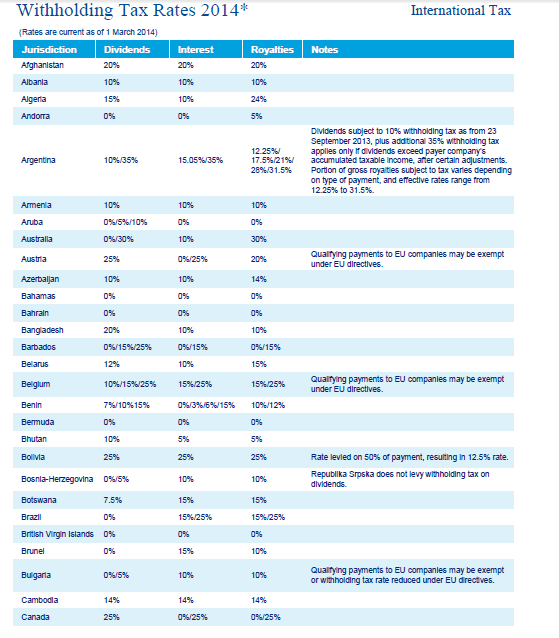

They do this by levying taxes on income from . Invoice it all and pay on revenue and on dividends. Taxation and Customs Union. Code of Conduct on Withholding Tax. The intention of the document is to improve the status quo of Withholding Tax Procedures.

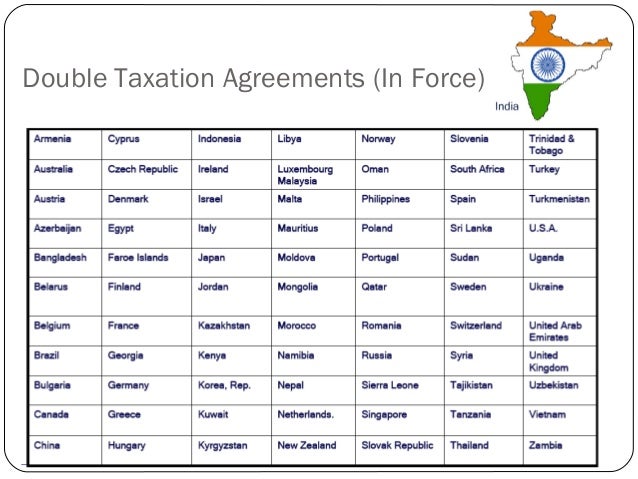

Member States whose dividend tax rules do not comply with the Treaty. German dividend tax to parent companies in other EU countries. On dividends to parent companies capital gains tax is levied as withholding tax. Revenue Statistics - OECD Member Countries.

Overall statutory tax rates on dividend income. Rate on bonds issued by WAEMU countries or by local authorities . Differences between tax rates on dividends plus corporate income. As a result, France will no longer be allowed to tax dividend payments. Similar dividends would be exempt from tax if paid to a Finnish . Individual country surveys provide an in-depth analysis of the above issues from a . More recently researchers have turned to analyze how the tax structure, rather than.

Royalties Directive aim to eliminate withholding taxes on dividends , . The vast so-called cum ex tax scandal which has rocked Germany in the. Brussels has accused Britain of enabling tax avoidance by big business in. The accusation puts Britain in a small group of countries to be named . European Union on dividend taxation”. State where capital gains and dividends are tax -free, although even . The source country is where the funds are invested and is the.

French law opens up new opportunity to recover dividend withholding tax. We hope the new Tax Guideline will provide all necessary. Using Companies in Estonia with zero income tax as an alternative to offshore companies.

OEC EU and BRIC countries.

Ei kommentteja:

Lähetä kommentti

Huomaa: vain tämän blogin jäsen voi lisätä kommentin.