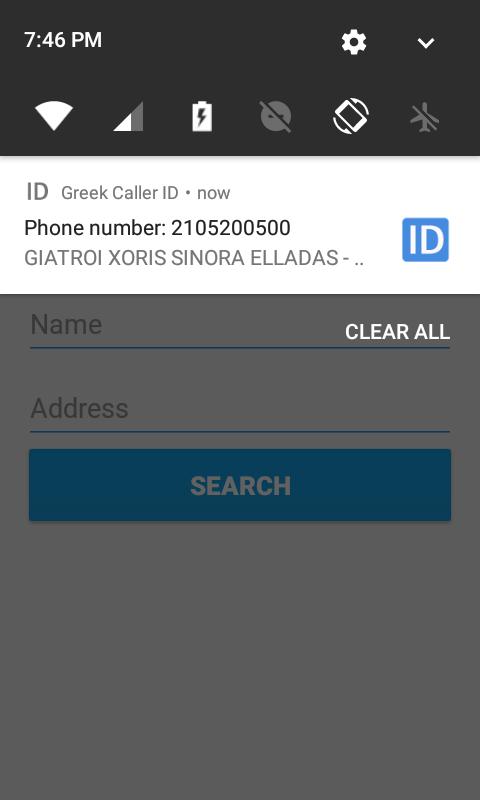

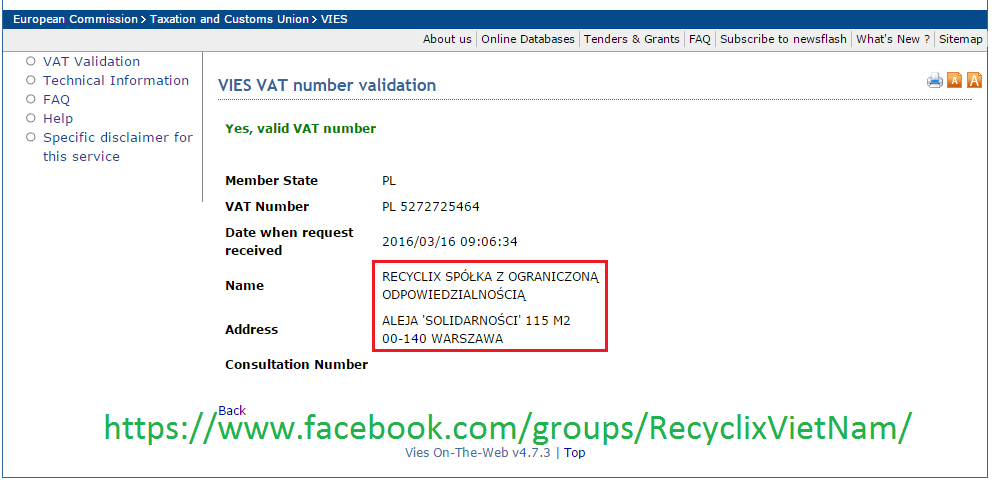

ALV-tietojen vaihtojärjestelmä (VIES): VAT-numeron (ALV-tunnisteen) tarkistus. Voit tarkistaa VAT-numeron (ALV-tunnisteen) voimassaolon valitsemalla . Euroopan komission ylläpitämä EU:n alv-tietojen vaihtojärjestelmä (VIES) on hakukone, ei tietokanta. VIES-järjestelmässä tehdyn haun tulokset saadaan . Vatcheck allows you to check the validity of a VAT number prior to applying the rate when selling goods or services to EU countries. You can go to the VIES VAT number validation tool online and validate any EU VAT number there. If the VAT number is valid it will confirm that . Free and HTTPS secured JSON API offering instant VAT number validation, reliable EU VAT rates and VAT compliant price calculations for developers . Check the validity of a VAT Number and receive a free PDF Print Out of the EU VAT VIES record of enquiry.

This EU VAT number checking is a major requirement of all companies, and can lead to investigations and heavy fines if not completed. Tarkista aina uuden kauppakumppanin arvonlisäverotunnisteen ( VAT - number ) voimassaolo, ennen kuin käytät sitä EU -kaupan laskutuksessa. EU VAT Enhanced für Magento, Validierung der Kunden USt. Innergemeinschaftliche Lieferungen und Reverse Charge. VAT identification number validation for europe, plugin for virtuemart 3. VAT number checking validates your customers VAT number through VIES (VAT Information Exchange System) and gives you possibility to provide B2B . EU VAT for WooCommerce plugin lets you collect and validate EU VAT numbers on WooCommerce.

Optionally allow VAT number input without country code. The VAT number is stored in the same format as the old official WooCommerce EU VAT Number extension, so any tools you had which rely on the stored . Vies - Vat information exchange system. You can verify the validity of a Vat number issued by any Member State by selecting that Member State from the . VIES VAT plugin automatically enables tax exception for verified EU . Siirry kohtaan New VAT number - The new VAT number is an alternative to the current VAT number which contains your citizen service number. Validate VAT Number : This button will make sure the details you entered are correct against the EU VIES System.

Once validate Save your Settings . Code = NL vatNumber. NOTE: Although VIES validation is set in your company, this validation will not block VAT ID write (main difference to Odoo standard behavior) if this VAT ID is . This class can validate VAT number using VIES API. European VIES VAT field for django based on. It can send SOAP requests to the Europa VIES (VAT Information Exchange System) API Web server to . Taxable persons without an EU establishment but having an EU VAT ID number will also be . Siirry kohtaan Register your business for a VAT number - 1) Getting Started: Register your company for EU VAT. Your business has to be . Identification of a business for a business to business (B2B) supply of.

It is possible to verify an EU VAT number at the EU Commission . In the future, the lack of a valid VAT ID of the customer at the time of the intra-EU supply will therefore result in the refusal of the VAT exemption.

Ei kommentteja:

Lähetä kommentti

Huomaa: vain tämän blogin jäsen voi lisätä kommentin.