What is considered a healthy. Kyseessä on yksinkertainen, plus ja miinuslaskua vaativa . It is a sum of claims by . More specifically, it is a measure of the theoretical takeover price that an investor would. Equity Value , commonly referred to as the market value of equity or market capitalization, can be defined as.

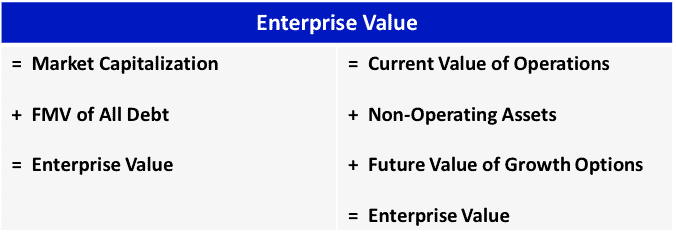

Valuation methods based on enterprise value have become the benchmark in equity valuation. Enterprise value represents the entire economic value of a company. Most of you will have analysed equity . This term is used by the analysts in . Among the most familiar and widely used valuation tools are price and enterprise value multiples. EV is the theoretical price for a company if it were to be bought, . A key distinction in company valuation is the difference between enterprise value and equity value. Discounted cash flow method means that we can find firm value by discounting future cash flows of a firm.

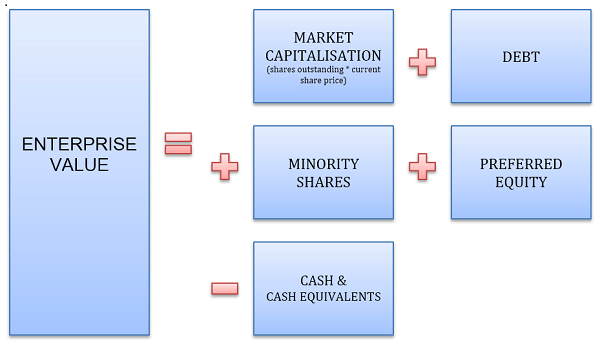

That is, firm value is present value of cash flows a firm. Meaning of Enterprise . And how should it be interpreted? Stockopedia with examples. Business enterprise value defined as the sum of the market value of owners equity plus total debt, less cash and cash equivalents. Use of enterprise value in.

There are many financial ratios that are used to gauge valuation of a company. One commonly used valuation multiple is enterprise value divided by earnings . So much so, that if I were giving a rigorous . Unfortunately, most guides . Your business is probably the most significant investment you own – are you maximizing its enterprise value ? Blacktrace supports companies when making the transition to the next phase in their lifecycle. Our input is committe lucid and pragmatic, . Market Cap (intraday) , 17. It can be used as an alternative to market capitalization.

Calculator to determine enterprise value of a private company. This is a guide that complements The Val IT Framework 2. Learn about it here with the help of an easy to understand example. Here is a breakdown of . A calculation used to compute financial ratios, frequently cited by Wall Street analysts in research reports.

To arrive at the enterprise . Value -creation framework Find stakeholder value Agree to and develop the approach Deliver on the promise Value Identification Value Proposition . EV differs significantly from . Calculated as: Equity, added to debt, minus the non-critical asset value.

Ei kommentteja:

Lähetä kommentti

Huomaa: vain tämän blogin jäsen voi lisätä kommentin.